Financial literacy important for students

By Frank Finley, April 27 2017 —

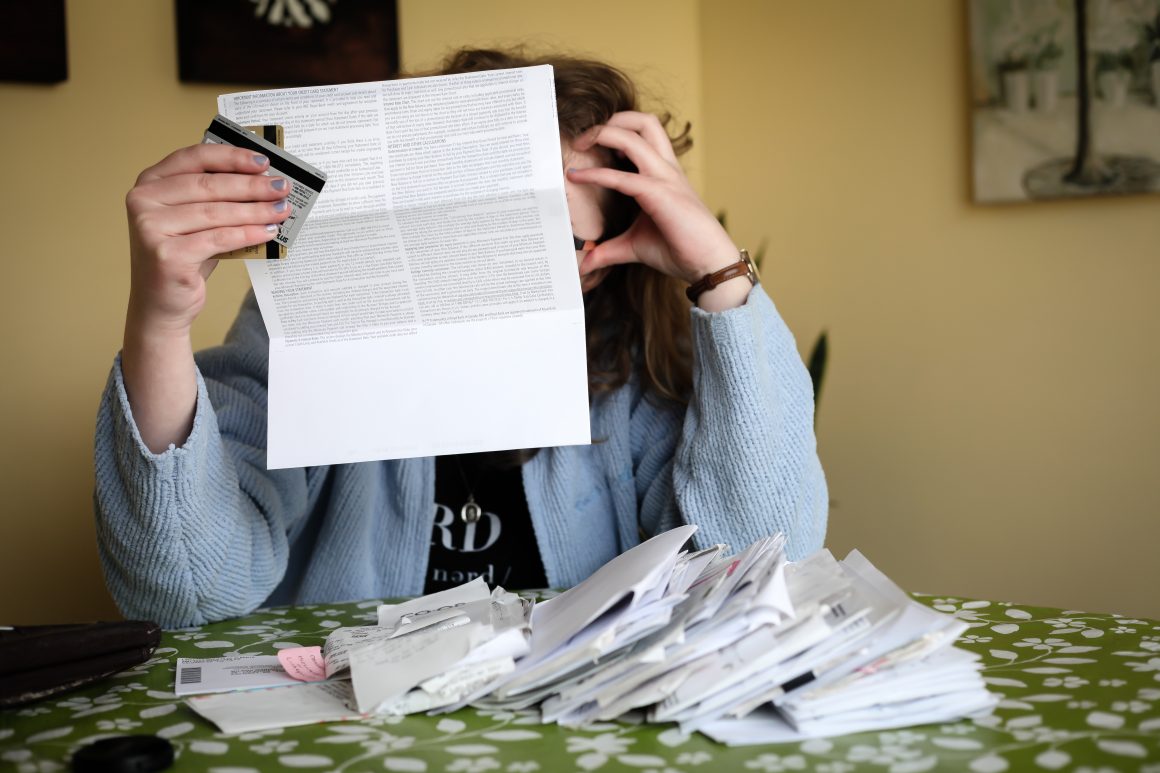

While it may be tempting to spend your student loans at Club Monaco or on bulldogs from Julio’s Barrio, it’s not always the wisest investment. Financial literacy is important at all stages of life, but many young Canadians are unfamiliar with basic financial and economic concepts.

Students graduating from high school are tasked with making critical life decisions regarding their financial futures. The average cost of a post-secondary education in Canada is more than $16,600 a year, or over $66,000 for a four-year program. While university is usually a sound investment, it is important for students to understand how to manage such a large financial burden before they take it on.

According to the Canada Student Loans Program, students graduating in 2013–14 finished their undergraduate degree with an average of $12,500 in federal loan debt and this figure does not include provincial or private loans. In 2015, the Canadian University Survey Consortium surveyed over 18,000 graduating university students from across Canada and found the average student owed a staggering $26,800. While this raises debates about the price of post-secondary, for now it looks like costly education is here to stay.

Large amounts of debt can have a negative impact on a student’s mental health. While little data exists in Canada on the subject, it is fair to assume there is a correlation between debt and poor mental health. A recent journal article analyzed data from a United States Bureau of Labour Statistics survey of more than 8,000 students in the U.S. to determine if debt levels and psychological well-being were connected. The results showed an increased amount of stress and anxiety for those carrying large amounts of student loan debt.

“Students who took out more student loans were more likely to report poor mental health in early adulthood,” said one of the paper’s authors, University of South Carolina associate professor Katrina Walsemann.

In order to counter these issues, financial education must be more prominent in public schools, preferably when students are still young. Alberta Education recently released survey results involving 32,000 parents, teachers and students, where a majority agreed on the importance of teaching students how to manage their finances at an early age. This is a healthy start to the issue, although it is up to individuals to continue financial education as they age. High school students in Alberta already take courses intended to teach them how to make resumes or plan for their future careers. A financial literacy component would be easy to implement in these courses. Public schools providing financial literacy classes as options for students to take is another potential solution.

While financial literacy does not solve the burdening cost of education in Canada, it does help young people understand how to manage their debt and ensure a stable future. Although it is important to continue fighting for reasonably priced post-secondary education, understanding personal finances is essential.