Alberta needs to overhaul tax policy for short-term jobs

By Jesse Stilwell, September 5 2017 —

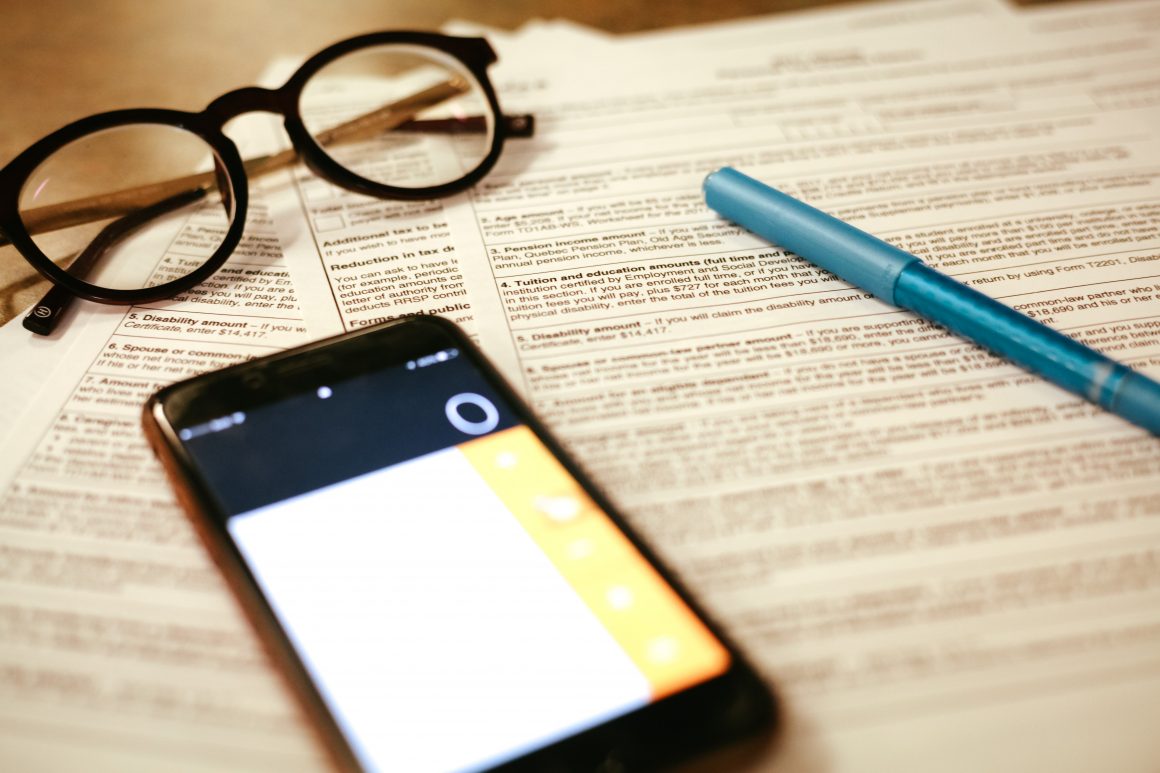

Summer is over, and for many students, that means their summer job contracts are ending. Many students work during the summer on short-term contracts, where they make just enough money to get them through the year. Some of these jobs even come with a larger salary than they would if they were permanent because of their short duration. Unfortunately, some students are taxed as if they were making that salary for a full year.

This doesn’t make a difference in the long term. Most of these students will receive a large tax refund in April once they’ve shown they didn’t receive additional income beyond the summer. Some argue that paying these taxes is just like forcing them to save and the lump sum they’ll receive after tax season will make it worth the wait. But this doesn’t take away from the heavy tax burden students feel while they are working. It’s difficult to save up money for the months between September and April, especially when a large chunk of every pay cheque disappears to the government — even if they’ll get it back once the school year is over.

I moved to a different city for a summer job this year. This meant I was not only saving money for the fall, but I was also renting an apartment, buying groceries and keeping my car running. I was taxed as if I was going to make close to $70,000 this year while I took home roughly $10,000 total. I even declared that I would be making less than the total claim amount shown on my tax forms, but due to the salary that was attached to my job title, that was ignored.

Knowing that a big chunk of every paycheque went to Canadian Income Tax and was therefore temporarily withheld from me by the government was frustrating. Having some of that money in my possession throughout the school year would make my life much more comfortable.

Luckily, there’s a simple solution to this problem. A policy should be put in place to make it easier for employers and employees to communicate that a job is seasonal and that the salary should not be extrapolated to a year’s worth of earnings. It’s a waste of government time and resources to levy taxes only to pay them back to civilians months later when they could instead know the accurate amount that student will be earning and never take the excess taxes at all.

It’s also inconvenient for students to organize and file a tax return in the notoriously busy month of April. And while using a tax refund service offered at many banks would make the situation easier in theory, the cost can be prohibitive. It’s in everyone’s best interest to more accurately codify students’ earnings to avoid unfairly levying massive taxes on summer workers.